.jpg)

The European automotive industry, once a pillar of the continent's economy, is facing unprecedented challenges. Emerging technologies, such as Electric Vehicles (EVs) and Advanced Driver Assistance Systems (ADAS), are reshaping the landscape. Non-European players, especially in the EV market, have surged ahead, while traditional European giants are losing ground. The main challenges faced:

1. Competing with Profitable Supply Chains: European OEMs struggle with operational inefficiencies, resulting in lower margins and longer cycles. Newer competitors excel with efficient production and supply chains.

2. Mastering Technology Commercialization: New tech companies efficiently monetize R&D investments, highlighting the importance of translating innovation into revenue.

3. Achieving Capital Efficiency: Emerging players grow with less capital expenditure, leveraging advanced technologies and partnerships for financial stability.

4. Chasing Faster Growth: New suppliers show significantly higher growth rates than established players, signaling changing market dynamics.

5. Access to Capital: New players have larger market capitalization, granting them more access to capital for further growth and innovation.

This cycle of growth reinforces itself, creating an imbalance that threatens the competitiveness of European OEMs. To respond, European companies must adapt swiftly, embrace innovation, and explore collaborations.

European Automobile Manufacturers' Association (ACEA) just released their latest The Automobile Industry Pocket Guide emphasizing the automotive industry's vital role in Europe's economy. It invests €59.1 billion, comprising 31% of the EU's R&D spending, driving technological progress that surpasses pharmaceutical and biotech sectors combined, making it a pioneer in technological advancements within Europe. Employing 2.4 million employees directly and a total of 12.9 million, it represents 7% of EU jobs, contributing to economic stability. This makes the automotive industry a cornerstone of Europe's wealth.

Nonetheless, this wealth is currently facing significant risks. Emerging technologies such as Electric Vehicles (EVs) and Advanced Driver Assistance Systems (ADAS) have become increasingly crucial. These advancements demand different components, technologies, and capabilities, giving rise to new industry players.

For instance, in the EV market, non-European Original Equipment Manufacturers (OEMs) have taken the lead, particularly in the United States with companies like Tesla, Rivian, or Lucid Motors, as well as in China with BYD, XPENG, Great Wall Motor Co., Ltd., and NIO. Meanwhile, the prominence of European giants such as Volkswagen Group, AUDI AG, Mercedes-Benz AG, and BMW Group is steadily diminishing. This shifting landscape underscores the growing competition that European automakers face from their international counterparts.

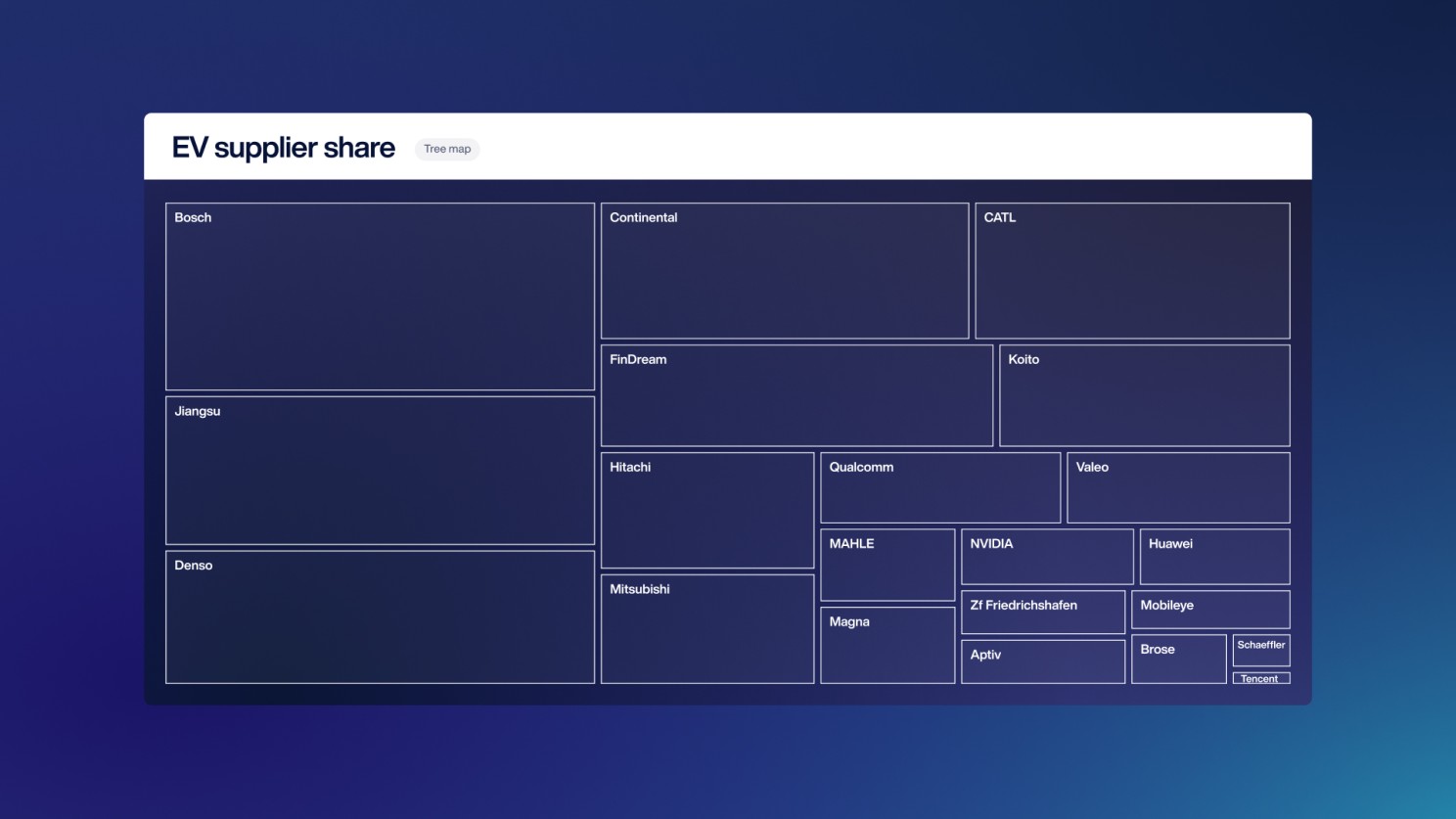

The pattern of non-traditional and non-European players gaining ground extends beyond the automotive manufacturers themselves. In the Tier 1 supplier market for EVs, we observe a similar trend, with companies like Contemporary Amperex Technology Co., Limited, Mobileye, and NVIDIA playing increasingly important roles. Furthermore, the involvement of major tech giants like Waymo from Alphabet Inc. and Apple (Car OS) is yet to fully materialize, suggesting that even more disruptive changes may be on the horizon.

The challenges faced by European firms in gaining relevance in emerging technologies are multifaceted and significant. Let's explore the major problems faced.

The traditional players among European OEMs face a notable challenge when it comes to their operational efficiency. These companies often contend with significantly lower gross margins and extended operating cycles compared to their newer, more agile competitors. One of the key reasons behind this disparity lies in the more efficient and profitable production and supply chains that the emerging competition has embraced.

In today's tech arena, success isn't just about inventing cutting-edge technology; it's about turning innovation into revenue. New tech competitors have mastered this art, as measured by their impressive Research and Development (R&D) turnover. This metric reflects their ability to generate substantial income for every dollar invested in R&D.

Unlike their predecessors, these agile suppliers are achieving substantial growth with less capital expenditures (CapEx). They rely on advanced technologies, strategic partnerships, and outsourcing to maximize their asset utilization. This approach not only enhances financial stability but also enables quick adaptation to market changes and technological advancements.

The normalized year-over-year (YoY) growth rates (EMA) seen among emerging tier 1 suppliers, often exceeding those of established players, reflect the shifting dynamics of the global market. In contrast, traditional tier 1 suppliers are grappling with stagnation, with revenue growth rates hovering between three to ten times lower than those of their newer counterparts.

In the quest for a fairer comparison between established players and newcomers in the automotive industry, it's imperative to consider a metric that balances growth and profitability. Enter the "Rule of 40," a metric originally popularized in the Software-as-a-Service (SaaS) realm. The Rule of 40 offers a holistic view of a company's financial health, encapsulating its EBIT (Earnings Before Interest and Taxes) margin alongside its revenue growth rate.

The significant market capitalization enjoyed by these new players, often ranging from tenfold to several hundred times higher than that of traditional counterparts, equips them with substantial access to capital. This access, in turn, provides them with a unique opportunity to fuel further growth through strategic initiatives like mergers and acquisitions (M&A) and additional investments in research and development (R&D).

This cycle of growth, where increased market capitalization facilitates more significant investments in expansion and innovation, creates a reinforcing loop. In contrast, European OEMs find themselves caught in a downward spiral of diminishing market capitalization and limited access to resources. As a result, this imbalance can lead to an exponential decline in their competitiveness and relevance in the rapidly evolving automotive landscape.

In this environment, every day becomes crucial for European OEMs, highlighting the urgency for them to swiftly adapt, embrace innovation, and explore collaborative strategies to regain their foothold in an industry where disruption is the new norm.

Under those circumstances, executives are navigating uncertainty, complexity, and rapid changes of an unprecedented scale. These challenges surpass any that managers have faced in the past. In these times, a company's and Europe's economic success hinges on just two critical factors: luck and the quality of decisions made by its leaders.

That's precisely why we've developed DeOS - the Decision Optimization System, a cutting-edge solution designed to transform information into tangible, superior business outcomes. DeOS leverages the power of artificial intelligence to augment managers in critical use cases, including but not limited to Research and Development (R&D) investments, portfolio management, new product development, market entry strategies, digital transformation initiatives, and Mergers and Acquisitions (M&A).